11 November 2025

Challenging trading conditions in Q1 impacting first half; positive momentum returning

Oxford Instruments plc, a leading provider of high technology products and systems for industry and research, today (11 November 2025) announces its interim results for the six months to 30 September 2025.

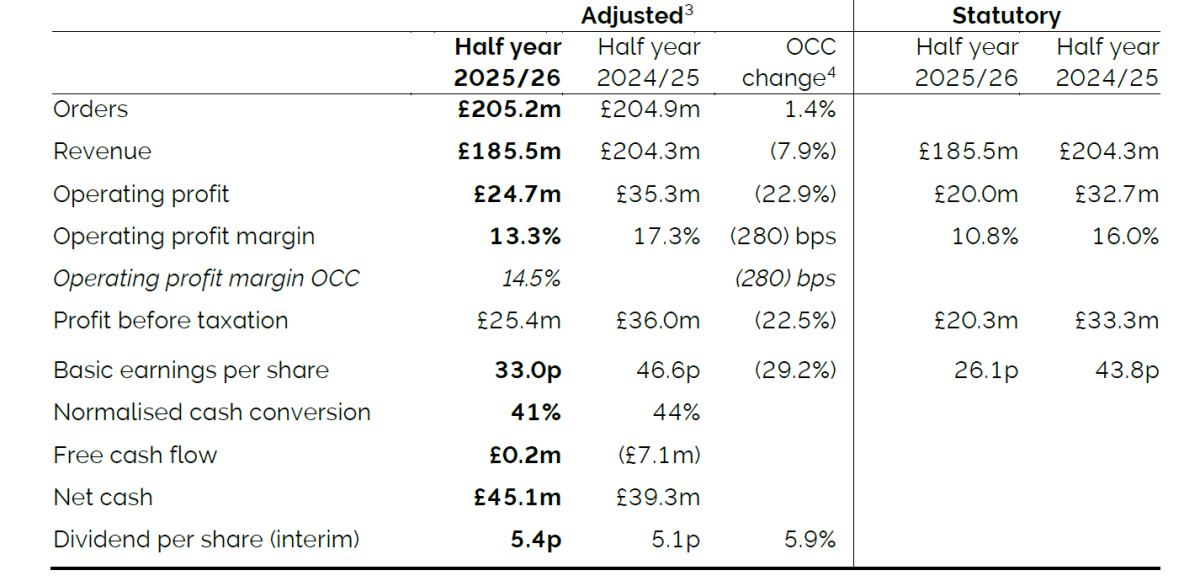

Summary of half year*

- The business is recovering following significant macroeconomic disruption in Q1, with order momentum improved in Q2, back to levels in line with last year

- Actions taken within Imaging & Analysis (I&A) in H1, including adjusting some assembly locations and restructuring Belfast cameras and microscopy cost base, alongside successful re-pricing of US open order book to mitigate tariff impact

- Positive momentum in Advanced Technologies (AT) compound semiconductor business, with new clean room fully operational. Strong order demand, driven by US and European commercial customers, has resulted in full order cover to support another year of strong growth

- Completion of sale of NanoScience business expected in Q3 once regulatory approvals received

- The Group’s H1 actions and a recovery in order intake are expected to lead to a full-year performance consistent with our October trading update (see note 2)

- Current buyback programme to be increased by a further £50m, to £100m. As at 31 October, £32m already completed

* see note 1

Financial highlights

- Order intake up 1.4% OCC year-on-year; Q1 orders down 3.0% OCC followed by 5.7% OCC growth in Q2; Book-to-bill at 1.1x (see note 5):

- Greater Q1 order disruption in Imaging & Analysis, our relatively higher margin, shorter lead time division, followed by recovering momentum to flat Q2, leading to H1 orders down 6%

- 25.3% OCC order growth in Advanced Technologies, led by augmented reality and datacomms compound semiconductor applications and six-fold expansion into higher volume commercial customers

- Revenue down 7.9% OCC as business recovers from repricing order books and delayed shipments; Q2 order recovery supports a stronger H2 revenue performance

- High gross margin consistent with prior year; overheads slightly down on prior year following restructuring in Belfast and good cost management. Strong operational leverage expected in H2 as the benefits come through

- Revenue shortfalls in H1 dropped through to Group adjusted operating profit (£24.7m, down 22.9% OCC), and adjusted operating profit margin (13.3%, -280bps OCC)

- Strong balance sheet with £45.1m net cash (2024: £39.3m) at half year. Sales proceeds from NanoScience sale expected in Q3 (c. £57m); as at 31 October, £32m of £50m share buyback programme executed

- Normalised cash conversion 41% (2024: 44%), following profile of H1 revenue; expected to materially improve in H2

- FX headwind in H1 of £2.6m on adjusted operating profit. Full year impact expected to be £5.5m, in line with recent trading update and reflected in full-year guidance

- 5.9% increase in the interim dividend to 5.4p (2024: 5.1p)

Current trading and outlook

The business is recovering well following significant disruption in the early weeks of H1. Second half Imaging & Analysis order momentum is in line with expectations, with cost control actions taken in H1, notably in Belfast, underpinning expected margin improvement. A number of product launches are also expected to contribute to a stronger H2 for the division.

Within Advanced Technologies, strong positive momentum within the compound semiconductor business, driven by large commercial customers, has resulted in a robust order book to support another year of strong growth.

We expect to provide a further trading update on 15th January 2026.

Read the full interim results statement.

Richard Tyson, Chief Executive Officer of Oxford Instruments plc, said:

“During the first half we have made further progress in our strategic aims to simplify the Group, improve commercial execution and realign our regional presence. Our trading performance reflects that we, like others, have had to navigate the impacts of tariffs and the related global economic disruption.

“We expect trading performance in Imaging & Analysis to be stronger in the second half than the first, benefitting from increased order momentum and adjustments made to some product assembly locations, coupled with the impact of margin enhancement actions we took in the first half. In Advanced Technologies, we have had very strong order growth, with our new Bristol facility and leading technology helping us to secure orders from our target large commercial customers. We therefore expect the division to deliver another year of strong growth and improved margins supported by a full order book.

“I’m very proud of the commitment and drive shown by our teams globally. Thanks to their proactive response to disruption in our markets and the positive outcomes from our ongoing strategic programme, we expect to deliver an improved performance in the rest of the year.”

Notes:

1. Excludes all revenues and costs directly related to the NanoScience business which will exit the Group upon final deal closing. Any costs previously allocated to the NanoScience business which will not exit the business at deal close are presented within continuing operations. All prior year comparators are presented on the same basis. For reference, a pro-forma consolidated statement of income for FY25 for continuing operations is included in the Finance review.

2. Trading update issued Monday 13 October, guiding to full year revenue, adjusted operating profit (AOP) and AOP margin similar to FY24/25 on an organic constant currency basis.

3. Adjusted items exclude the amortisation and impairment of acquired intangible assets, acquisition items, business reorganisation costs, other significant nonrecurring items, and the mark-to-market movement of financial derivatives. A full definition of adjusted numbers can be found in the Finance review.

4. Organic constant currency (OCC) numbers are prepared on a month-by-month basis using the translational and transactional exchange rates which prevailed in the previous year rather than the actual exchange rates which prevailed in the year. Transactional exchange rates include the effect of our hedging programme. They also exclude the impact of acquisitions and divestment made in the comparator periods.

5. Book-to-bill is defined as orders received in the period divided by revenue in the period.

The financial information in this preliminary announcement has been prepared in accordance with UK adopted international accounting standards. The Group has applied all accounting standards and interpretations issued relevant to its operations and effective for accounting periods beginning on 1 April 2025. The UK adopted IFRS accounting policies have been applied consistently to all periods.

LEI: 213800J364EZD6UCE231

Oxford Instruments management will present its interim results at Deutsche Numis, 45 Gresham Street, London EC2V 7BF, to analysts and investors at 9:00 today (11 November 2025). The presentation will be streamed live at https://brrmedia.news/OXIG_HY2... and a recording will be made available later today at www.oxinst.com/investors/finan... .