13 October 2025

Interim trading update: Improved momentum through Q2, after tariff disruption in Q1. Expecting stable full year on an organic constant currency basis

Oxford Instruments plc, a leading provider of scientific technology and expertise to academic and commercial partners, is today issuing a trading update for the six months ended 30 September 2025 for continuing operations

The period saw contrasting order dynamics across our two divisions, with market turbulence, primarily due to tariffs and resulting global economic uncertainty, having a greater impact on order intake in our Imaging and Analysis (I&A) division than previously anticipated. In our Advanced Technologies (AT) division, market tailwinds in the compound semiconductor market, and our expansion into volume manufacturing customers, have continued to drive very strong order growth.

At Group level, this has resulted in first half order intake up just over 1% OCC2 versus prior year, with a Q1 decline of around 3%, followed by growth of nearly 6% in Q2. I&A order intake in Q1 was down 11%, and Q2 flat on prior year. AT order intake grew 25% in Q1 and 26% in Q2. Our half-year book-to-bill ratio is expected to be around 1.1 (1.0 H1 prior year).

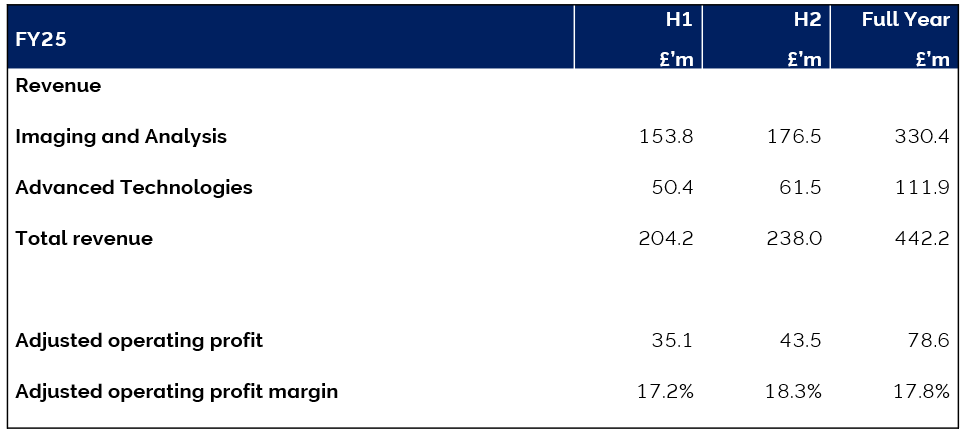

Given the profile of order intake, H1 revenues for the period are expected to be down around 8% OCC versus the prior year (down 10% on a reported basis).

The high contribution margin on I&A revenue lost in H1 is expected to result in an OCC adjusted operating profit margin for the period of around 14.5% (13.5% on a reported basis). We anticipate a substantially stronger H2 margin performance versus H1 as modest revenue growth resumes, in addition to a typically seasonally stronger H2, the benefit of Belfast cost savings, and other margin improvement initiatives implemented across the Group.

On a reported basis we expect H2 revenue to be marginally up versus H2 of the prior year. Consequently, on an organic constant currency basis we now expect Group full year revenue, adjusted operating profit3 (AOP) and AOP margin to be similar to the prior year.

Imaging & Analysis

As US tariff policy evolved through Q1 we successfully re-priced the majority of the US open order book to mitigate any profit impact. However, divisional order intake was impacted in Q1 as some academic and commercial customers delayed purchases in response to the shifting global trading environment and resulting broader uncertainty.

Consequently, order intake fell around 6% OCC in H1, with Q1 falling 11%, and Q2 in line with prior year. This contributed to OCC revenues being around 9% lower in H1 compared to the prior year (down nearly 11% on a reported basis).

Our teams have been agile and effective in responding to the shifting trading and tariff landscape, including adapting our manufacturing and supply chain footprint, and innovating around the challenges, including the supply of rare earth materials. We continue to monitor developments and are working to mitigate any potential impacts.

Business improvement actions already taken in our Belfast imaging business, including significant workforce reductions, a refocused product portfolio, and a renewed focus on key OEM partnerships, will all have a material positive impact on margins in H2. The pace of any recovery of the healthcare and life sciences market continues to be a key uncertainty for the Belfast business this year, with conditions remaining challenging. Our priority remains on winning greater market share through focused sales effort and new products.

Advanced Technologies

We continue to see strong positive momentum in our compound semiconductor business, with a 25% OCC growth in H1 orders and a full order book for H2. Augmented reality and datacomms applications have been the main drivers of order growth, with an increasing number of orders coming from major commercial players for volume manufacture applications. The move to the new Severn Beach facility is fully complete, with a significant positive impact on customer confidence and opportunity generation. We expect this positive momentum to continue into the remainder of the year.

Divisional H1 OCC revenue is expected to be around 7% lower than prior year (8% on a reported basis), primarily due to tariff-related delays in shipments to China from our US based X-Ray business, and the postponement of delivery of a limited number of high value compound semiconductor systems into Q3.

Currency

We anticipate a further headwind of approximately £1m to operating profit in addition to earlier guidance of £4.5m. This is reflected in our updated expectations for the full year.

Sale of NanoScience

The sale of the NanoScience business is progressing well and is expected to complete during Q3, in line with guidance.

Richard Tyson, CEO, Oxford Instruments plc, commented:

“The start of our financial year coincided with the beginning of a turbulent time in our markets, as others in the sector have commented on. I am proud of our team’s proactive and customer-focused approach to this very dynamic global trading landscape, driving an improving picture in Q2, albeit we are now assuming that we will not recover the H1 revenue shortfall.

“At the same time, it has been particularly pleasing to see demand for our compound semiconductor business continuing to grow at a fast pace. Our new Severn Beach facility, and the performance of our market-leading technologies, have proved to be clear differentiators for Oxford Instruments in the market.”

“Whilst the macro picture continues to be fluid, the agility of our teams, in combination with the strategic actions we have taken, gives us the confidence in delivering progress in H2.”